Robertsdale, Ala. — Forman Capital has provided a $20 million construction bridge loan to LV Petroleum, the largest owner and operator of TA Travel Center franchises in the United States, for the redevelopment and completion of a retail travel plaza in Robertsdale. Formerly the Oasis Travel Center, the property has already been converted into a TA Travel Center with all facilities operating, except for diesel fuel sales. Situated about 27 miles east of Mobile, the 51-acre site features 26,797 square feet of retail space, including Subway and Sbarro restaurants, eight …

Alabama

Montana Property Group Acquires 73,600-Square-Foot Retail Center in Huntsville, Alabama, for $12.5 Million

Huntsville, Ala. — New York City-based Montana Property Group (MPG) has acquired North Madison Corners, a 73,600-square-foot retail center located in Huntsville, for $12.5 million. Originally built in 2005, the center features a mix of eight tenants including Marshalls, Michaels, H&R Block, pOpshelf, European Wax Center, Massage Envy, Grill & Smoke BBQ Store and Pizza Hut. MPG’s Huntsville retail portfolio now totals 350,000 square feet. The seller was RAP Properties.

Merrill P. Thomas Co. Brokers $5.7 Million Sale of Paradise Isle Shopping Center in Gulf Shores, Alabama

Gulf Shores, Ala. — Locally based Merrill P. Thomas Co. has brokered the $5.7 million sale of Paradise Isle Shopping Center, a 47,520-square-foot shopping center located in Gulf Shores. Publix anchors the property, which is situated on 4.6 acres. Other tenants include AutoZone, Resale Heaven, Nail Boutique & Spa and the Gulf Shores Methodist Church. Pratt Thomas of Merrill P. Thomas Co. represented the seller, Gulf Shore Methodist Church, in the transaction. The buyer was an entity doing business as Paradise Isla Holdings LLC.

Boulder Group Arranges $6.3 Million Sale of Single-Tenant Retail Property in Mobile, Alabama

Mobile, Ala. — Chicago-based The Boulder Group has arranged the $6.3 million sale of a single-tenant retail property located at 1550 Government St. in Mobile. ALDI occupies the 42,510-square-foot building on a triple-net lease, which has more than 10 years remaining. Randy Blankstein and Jimmy Goodman of The Boulder Group represented the Canadian-based seller in the transaction. The buyer is a Michigan-based commercial real estate investment company. Other nearby retailers include Walgreens, Dollar Tree, Starbucks Coffee, Sherwin-Williams, Fresenius Kidney Care and Firestone Complete Auto Care.

Legacy Realty Negotiates Sale of 132,737-Square-Foot Shopping Center in Enterprise, Alabama

Enterprise, Ala. — Legacy Realty Group has negotiated the sale of Westgate Shopping Center, a 132,737-square-foot shopping center located in Enterprise, roughly 30 miles east of Dothan. Piggly Wiggly anchors the center, which features a mix of additional tenants including Petsense, H&R Block, Rituals Salon & Day Spa, Rent-A-Center, Metro by T- Mobile, Beef ‘O’ Brady’s and Yancey Parker’s. Built in 1966, the property is situated on 6.4 acres, according to LoopNet. Jacob Baruch, Daniel Baruch and Ari Warshaw of Legacy Realty Group Advisors represented the buyer in the transaction. …

RealSource Group Facilitates $3 Million Sale of Single-Tenant Retail Property in Gadsden, Alabama

Gadsden, Ala. — RealSource Group has facilitated the $3 million sale of a newly constructed, 2,500-square-foot single-tenant retail property located in Gadsden. Starbucks Coffee occupies the building on a 10-year, double-net-lease with 10 percent rental increases every five years. This transaction marks the first single-tenant Starbucks property sold in Alabama in 2025, according to RealSource Group. Austin Blodgett and Jonathan Schiffer of RealSource Group, in association with ParaSell Inc., represented both the Ohio-based private buyer and the Tampa, Florida-based private developer in the transaction.

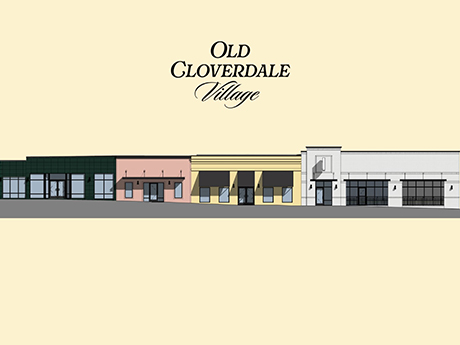

Montgomery, Ala. — A partnership between Birmingham, Alabama-based The FiveStone Group, Bayer Ventures and New York City-based D&A Cos. is underway with the redevelopment of Old Cloverdale Village, an 11,000-square-foot retail property located in Montgomery’s Old Cloverdale District. The project team comprises CCR Architecture & Interiors, Pilgreen and Bostick Engineering Inc. and Prier Construction. The partnership also includes Fresh Hospitality and Charles Morgan. The historic Old Cloverdale Village is home to various locally owned restaurants, pubs, specialty shops and art galleries, as well as an independent arts cinema and a volunteer …

Georgia and Alabama — Secure Properties has acquired a 12-property portfolio of Burger King-occupied restaurants across Georgia and Alabama for $20 million. The properties are leased to four tenants — including three franchisees and Burger King Corp., which operates four of the properties. Each of the properties is occupied on a long-term, triple-net-lease basis.

Montgomery, Ala. — Red Bank, New Jersey-based First National Realty Partners has acquired Country Club Centre, a 67,622-square-foot retail center located in Montgomery. The center — which was 85 percent leased at the time of sale — is anchored by Winn-Dixie, which totals 35,922 square feet. Additional tenants at the property include Dollar Tree, Martin’s Restaurant, Subway and Wingstop. Gary Chou of Berkley Capital Advisors represented the undisclosed seller in the transaction.

Dothan, Ala. — SRS Real Estate Partners has brokered the $7.7 million ground lease sale of a retail property located in Dothan. Built in 2004 and situated on 10.4 acres, The Home Depot occupies a 128,517-square-foot retail store on the site, which is adjacent to Northside Mall. Patrick Luther and Matthew Mousavi of SRS represented the seller, a Texas-based partnership, in the transaction. The buyer was a private investment firm based on the East Coast.