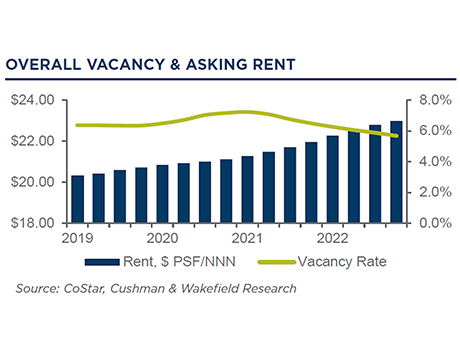

Chicago — Shopping center vacancy reached a record low during the fourth quarter of 2022, according to a report by Cushman & Wakefield. Vacancy rates declined 20 basis points quarter over quarter to 5.7 percent.

Of the 81 markets tracked by the firm, 66 experienced positive net absorption. Chicago saw the highest net absorption with 1 million square feet, followed by 788,000 square feet in Phoenix; 574,000 square feet in Atlanta; 422,000 square feet in Denver; 397,000 square feet in Washington, D.C.; 392,000 square feet in Dallas/Fort Worth; and 353,000 in New York City.

Several major cities saw a net decline in absorption during the same period, including Philadelphia; Hartford, Connecticut; and Buffalo and Albany, New York. Asking rents rose 0.8 percent quarter over quarter to an average of $22.99 per-square-foot.

“The economic backdrop has become highly uncertain over the last several months, with retailers preparing for more challenging conditions in 2023, yet retail fundamentals have not yet flinched,” says Barrie Scardina of Cushman & Wakefield. “Consumer behaviors remained healthy to close out the year: shopping mall foot traffic exceeded 2019 levels in the final two weeks of December, and holiday sales are expected to have been modestly positive. Inflation continues to be a concern for shoppers and retailers, though the rate of price increases moderated in recent months.”

—Hayden Spiess