Enterprise, Ala. — Legacy Realty Group has negotiated the sale of Westgate Shopping Center, a 132,737-square-foot shopping center located in Enterprise, roughly 30 miles east of Dothan. Piggly Wiggly anchors the center, which features a mix of additional tenants including Petsense, H&R Block, Rituals Salon & Day Spa, Rent-A-Center, Metro by T- Mobile, Beef ‘O’ Brady’s and Yancey Parker’s. Built in 1966, the property is situated on 6.4 acres, according to LoopNet. Jacob Baruch, Daniel Baruch and Ari Warshaw of Legacy Realty Group Advisors represented the buyer in the transaction. …

Alabama

RealSource Group Facilitates $3 Million Sale of Single-Tenant Retail Property in Gadsden, Alabama

Gadsden, Ala. — RealSource Group has facilitated the $3 million sale of a newly constructed, 2,500-square-foot single-tenant retail property located in Gadsden. Starbucks Coffee occupies the building on a 10-year, double-net-lease with 10 percent rental increases every five years. This transaction marks the first single-tenant Starbucks property sold in Alabama in 2025, according to RealSource Group. Austin Blodgett and Jonathan Schiffer of RealSource Group, in association with ParaSell Inc., represented both the Ohio-based private buyer and the Tampa, Florida-based private developer in the transaction.

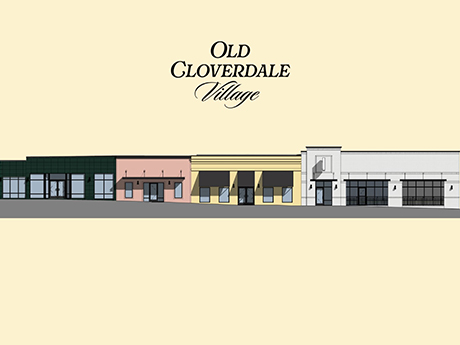

Montgomery, Ala. — A partnership between Birmingham, Alabama-based The FiveStone Group, Bayer Ventures and New York City-based D&A Cos. is underway with the redevelopment of Old Cloverdale Village, an 11,000-square-foot retail property located in Montgomery’s Old Cloverdale District. The project team comprises CCR Architecture & Interiors, Pilgreen and Bostick Engineering Inc. and Prier Construction. The partnership also includes Fresh Hospitality and Charles Morgan. The historic Old Cloverdale Village is home to various locally owned restaurants, pubs, specialty shops and art galleries, as well as an independent arts cinema and a volunteer …

Georgia and Alabama — Secure Properties has acquired a 12-property portfolio of Burger King-occupied restaurants across Georgia and Alabama for $20 million. The properties are leased to four tenants — including three franchisees and Burger King Corp., which operates four of the properties. Each of the properties is occupied on a long-term, triple-net-lease basis.

Montgomery, Ala. — Red Bank, New Jersey-based First National Realty Partners has acquired Country Club Centre, a 67,622-square-foot retail center located in Montgomery. The center — which was 85 percent leased at the time of sale — is anchored by Winn-Dixie, which totals 35,922 square feet. Additional tenants at the property include Dollar Tree, Martin’s Restaurant, Subway and Wingstop. Gary Chou of Berkley Capital Advisors represented the undisclosed seller in the transaction.

Dothan, Ala. — SRS Real Estate Partners has brokered the $7.7 million ground lease sale of a retail property located in Dothan. Built in 2004 and situated on 10.4 acres, The Home Depot occupies a 128,517-square-foot retail store on the site, which is adjacent to Northside Mall. Patrick Luther and Matthew Mousavi of SRS represented the seller, a Texas-based partnership, in the transaction. The buyer was a private investment firm based on the East Coast.

Irondale, Ala. — CBRE has secured a $15 million loan to refinance Cahaba Crossing, a 67,874-square-foot shopping center located in the Birmingham suburb of Irondale. Construction of the property was completed in 2023. A 48,837-square-foot Publix supermarket anchors the property. The 9.8-acre property, which is fully leased, comprises 10 tenants including The UPS Store, Starbucks Coffee and Heartland Dental. Additionally, there is a 1.45-acre outparcel reserved for future development. Carmel, Indiana-based 40|86 Advisors provided the five-year fixed-rate, interest-only loan. Richard Henry, Mike Ryan, Brian Linnihan and JP Cordiero of CBRE …

Madison, Ala. — Fairway Investments has sold Heritage Square, a 60,767-square-foot retail center located in Madison. Halpern Enterprises acquired the property, which is anchored by T.J. Maxx, for an undisclosed price. Built in 2008, the center was fully leased at the time of sale. Franklin Street represented Fairway Investments in the transaction.

Birmingham, Ala. — Gulf Coast Commercial has acquired River Ridge, a shopping center located in Birmingham, for $27 million. Nuveen Real Estate, which purchased the property in 2007, was the seller. Tenants at the center, which was 75 percent leased at the time of sale, include Academy Sports + Outdoors, Marshalls, World Market and Dollar Tree. Jim Hamilton and Brad Buchanan of JLL Capital Markets represented the seller in the transaction.

Montgomery, Ala. — Matthews Real Estate Investment Services has brokered the sale of Promenade North Shopping Center, a 57,441-square-foot retail center located in Montgomery. Tenants at the property, which was 97.3 percent leased at the time of sale, include Harbor Freight Tools, AutoZone and ArchWell Health. Pierce Mayson and Kyle Stonis of Matthews represented the seller, an affiliate of Hackney Real Estate Partners, in the transaction.