Costa Mesa, Calif. — Continental Realty Corp. has secured a $66 million loan for the acquisition of The South Coast Collection (SOCO), a 291,977-square-foot shopping center located in Costa Mesa, roughly 40 miles outside Los Angeles. Daniel Rosenberg and Logan Petersmeyer of BWE arranged the five-year, fixed-rate financing on behalf of Continental.

Finance

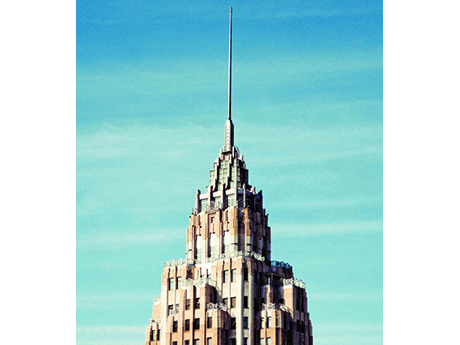

New York City — JLL Capital Markets has arranged $395 million in refinancing for 70 Pine Street, a mixed-use property located in the Financial District of New York City. Originally built in 1932 and renovated in 2016, the 66-story property features 39,075 square feet of retail space, in addition to 612 rental residences and a 165-room hotel. Christopher Peck, Geoff Goldstein and Christopher Pratt of JLL secured the financing through Goldman Sachs on behalf of the borrowers, DTH Capital and Rose Associates. Retailers at the building include restaurants SAGA and Crown …

Riverside, Calif. — Gantry has arranged a $12.8 million permanent loan for the refinancing of a 99,000-square-foot retail property located in Riverside. Stater Bros. Markets, AutoZone and Ross Dress for Less anchor the property, which is situated within the Citrus Landing shopping center. Braden Turnbull, George Mitsanas and Austin Ridge of Gantry secured the five-year financing through a life insurance company on behalf of the borrower.

Mesa, Ariz. — An entity doing business as Mesa South Center LP has received $8 million in financing for the acquisition of Mesa South Shopping Center, a 133,663-square-foot retail center located in Mesa. The borrower purchased the property for $15 million. Tenants at the center, which was 85.3 percent leased at the time of sale, include Big 5 Sporting Goods, Harbor Freight Tools and Dollar Tree. The property was originally built in the 1980s but has undergone renovation, including recent capital investments to the parking lot. Shaun Moothart, Bruce Francis, Bob …

Austin, Texas — Cushman & Wakefield has arranged $100 million in refinancing for a portfolio of grocery-anchored retail centers on behalf of the borrower, Austin-based Epic Real Estate Partners. Totaling 625,000 square feet, the portfolio includes Eagan Towne Center in Eagan, Minnesota; Ventana Village in Tucson, Arizona; Preston Trail Village in Dallas; Kauai Village in Kapa’a, Hawaii; and Cobbler Crossing in Elgin, Illinois. The properties, which were 93.2 percent leased at the time of sale, are anchored by Cub Foods, Kroger, Bashas, Safeway and Jewel Osco. Beth Lambert, Chase Johnson, Caleb …

Miami — Terra and Grass River have secured $245 in permanent financing for Grove Central, the developers’ recently completed mixed-use project in the Coconut Grove neighborhood of Miami. JP Morgan Chase & Co. issued the loan, which will be used to pay off the development’s existing construction loan, provided in 2021 by Apollo Global Management. The property features a 23-story residential tower, as well as 170,000 square feet of retail space. More than 95 percent of the retail space has been leased to tenants including Target, Sprouts Farmers Market, Club Studio, …

Hyattsville, Md. — JLL Capital Markets has arranged an $18.4 million loan to finance the acquisition of Metro Shops, a retail center located in the Washington, D.C. suburb of Hyattsville. Built in 2007 at 2900 Belcrest Center Drive, the property totals 160,623 square feet and is situated across from the 1 million-square-foot Mall at Prince George’s. Tenants at the center include Bob’s Discount Furniture, Staples, LA Fitness, Citibank and Dunkin’ Donuts. Michael Klein, Max Custer, Brian Buglione and Benjamin Morgenthal of JLL secured the financing through Loews Corp. on behalf of …

Delray Beach, Fla. — Berta Management has secured an $18.5 million loan for the refinancing of Delray Corner, an 86,043-square-foot shopping center located in Delray Beach. Justin Neelis of Concord Summit Capital arranged the five-year, fixed-rate financing on behalf of the borrower. Michaels is scheduled to open a 25,600-square-foot store in the first quarter of this year as the new anchor tenant, taking over a renovated space formerly occupied by Bed Bath & Beyond. Other tenants at the property include Conviva, CVS/pharmacy and Starbucks Coffee.

Albuquerque, N.M. — Ariel Property Advisors has arranged a $5.5 million loan for the refinancing of Guadalupe Plaza, an 87,000-square-foot retail center located in Albuquerque. Matt Swerdlow, Matthew Dzbanek and Rhea Vivek secured the 15-year refinancing on behalf of the borrower, a New Jersey-based investor. The loan features one year of interest-only payments and a 30-year amortization with no prepayment penalty.

New York City — Retailer Macy’s has rejected a $5.8 billion buyout offer from Arkhouse Management Co. and Brigade Capital Management. In December 2023, the investor group submitted a bid to acquire the outstanding shares of the company not already owned by Arkhouse and Brigade for $21 per share in cash. The Macy’s board of directors has since determined “not to enter into a non-disclosure agreement or provide any due diligence information to Arkhouse and Brigade,” according to a press release from the company. A letter to the would-be buyers cited …