Tukwila, Wash. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged a $23.4 million acquisition loan for Park Place, a regional strip center in Tukwila, about 12 miles from Seattle. Ray Allen of IPA’s Seattle office secured the 10-year financing, which features a loan-to-value ratio of 65 percent and a 3.5 percent interest rate. Built in 1996, the property features 153,454 square feet of retail space, and is located at 17501 Southcenter Parkway. Current tenants include JoAnn Fabrics, K&G, HomeGoods, Ashley Homestore and PetSmart. The buyer …

Finance

Beverly Hills, Calif. — Gantry has secured $38 million in financing for the fee-simple interest in a retail property located at the corner of Rodeo Drive and Brighton Way in Beverly Hills. The parcel is subject to a long-term ground lease and features improvements including an 18,380-square-foot high-street retail structure. Tenants at the property include Guess, Goyard, Bulgari, Wolford, Chrisofle and Bonpoint. Andy Bratt and Amit Tyagi of Gantry arranged the loan on behalf of the borrower, a private generational real estate family.

Nanuet, N.Y. — IDB Bank has provided a $19 million loan for the refinancing of a 220,000-square-foot retail property located north of New York City. The property, which formerly housed a Macy’s but is now anchored by home improvement retailer At Home, sits adjacent to Shops at Nanuet, an outdoor lifestyle center owned by Simon Property Group. Chris Kramer, Dustin Stolly and Jordan Roeschlaub of Newmark placed the loan with IDB Bank on behalf of the borrower, a partnership between Metropolitan Realty Associates and Angelo Gordon that acquired the property …

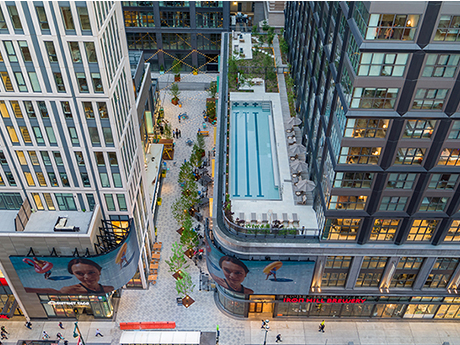

Philadelphia — JLL has arranged a $260 million loan for the refinancing of East Market, a mixed-use project that spans an entire city block in Philadelphia’s Center City neighborhood. East Market consists of two apartment buildings totaling 562 units, 120,000 square feet of retail and restaurant space and a 100-year-old warehouse that has been redeveloped into creative office space. Chad Orcutt and Blaine Fleming of JLL arranged the loan through Pacific Life Insurance Co. on behalf of the borrower, a joint venture led by National Real Estate Advisors.

Long Beach, Calif. — Gantry has arranged a $33.3 million refinancing for Marina Pacific Shopping Center, a 296,958-square-foot property located along the Pacific Coast Highway in Long Beach. George Mitsanas, Peter Hillakas and Austin Ridge of Gantry’s Los Angeles production office represented the borrower, a private investor, in the financing. The property’s tenants include Ralphs Supermarket, Nordstrom Rack, Barnes & Noble, AMC Theatres, LA Fitness and Howards Appliances.

Kearny Mesa, Calif. — JLL Capital Markets has arranged an $11.7 million refinancing for The Convoy, a 51,623-square-foot neighborhood strip retail center in Kearny Mesa, about 9 miles north of San Diego. Chris Collins and Daniel Pinkus of JLL secured the seven-year, fixed-rate loan through a regional credit union on behalf of the borrower, CEG Capital Partners. Proceeds will be used to refinance the existing bridge loan used to acquire the property in 2017. Originally constructed in 1973, the single-story property is fully leased to tenants including Bank of Hope, …

Cleveland — KeyBank Real Estate Capital (KBREC) has provided $51.6 million in acquisition financing to First National Realty Partners for three retail centers in Ohio, Oklahoma and Pennsylvania. Acquisitions include Southland Crossings, a 245,678-square-foot center in the eastern Ohio city of Boardman that is anchored by Giant Eagle, Michaels, Ross Dress for Less and PetSmart; Summit Square, a 166,552-square-foot property in Tulsa, Oklahoma, that is anchored by Reasor’s Foods, American Freight and Tuesday Morning; and The Village at Pittsburgh Mills, a 161,079-square-foot center in Tarentum, Pennsylvania, that is anchored by …

Garland, Texas — Northmarq has arranged an $11.5 million acquisition loan for North Garland Crossing, a 75,811-square-foot shopping center in the northeastern Dallas suburb of Garland. Shadow-anchored by a Super Target, the center was built in 2004 and houses tenants such as Michaels, PetSmart, AT&T and Starbucks Coffee. David Garfinkel and Ron Reese of Northmarq arranged the debt on behalf of the buyer, Bianco Properties. Mutual of Omaha provided the loan.

Lawrenceville, N.J. — Houlihan-Parnes Realtors LLC has arranged a $22.7 million loan for the refinancing of a 393,430-square-foot shopping center in Lawrenceville, a suburb of Trenton. Tenants at the property include Lidl, Starbucks, AutoZone, Five Below and Aspen Dental. Bryan Houlihan and James Houlihan of Houlihan-Parnes arranged the five-year, fixed-rate loan on behalf of the borrower, JJ Operating Inc., a family-owned investment and management firm based in New York City. An undisclosed local bank provided the debt.

Memphis, Tenn. and Birmingham, Ala. — Aztec Group has secured a total of $43 million in acquisition financing for two shopping centers, Ridgeway Trace in Memphis and Promenade Fultondale in Birmingham. Brell Tarich and Charles Penan of Aztec Group secured the two non-recourse loans on behalf of LBX Investments. Ridgway Trace is a 169,000-square-foot big box retail center. The $26.5 million loan for Ridgeway Trace features a 7-year term, fixed interest rate, several years of interest only payments and was provided by an undisclosed national insurance company. Ridgeway Trace was …