Attleboro, Mass. — JLL Capital Markets has arranged the sale of a 115,650-square-foot, single-tenant retail property net-leased to BJ’s Wholesale Club in Attleboro, roughly 10 miles north of Providence. Nat Heald, Chris Angelone and Zach Nitsche of JLL Capital Markets represented the undisclosed seller in the transaction. BJ’s has operated at this location since the building was constructed in 2011.

News

McAllen, Texas — Faris Lee Investments has arranged the $7 million sale of a 65,000-square-foot retail property currently under development in McAllen. The property is triple-net-leased to Floor & Décor, which is scheduled to open on March 3. Jeff Conover and Scott DeYoung of Faris Lee represented the seller, a Texas-based developer, in the transaction. The buyer was a Texas-based 1031 exchange investor.

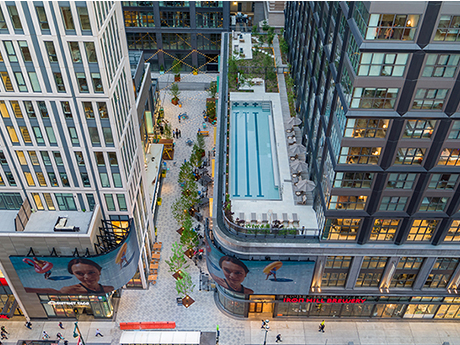

Philadelphia — JLL has arranged a $260 million loan for the refinancing of East Market, a mixed-use project that spans an entire city block in Philadelphia’s Center City neighborhood. East Market consists of two apartment buildings totaling 562 units, 120,000 square feet of retail and restaurant space and a 100-year-old warehouse that has been redeveloped into creative office space. Chad Orcutt and Blaine Fleming of JLL arranged the loan through Pacific Life Insurance Co. on behalf of the borrower, a joint venture led by National Real Estate Advisors.

Long Beach, Calif. — Gantry has arranged a $33.3 million refinancing for Marina Pacific Shopping Center, a 296,958-square-foot property located along the Pacific Coast Highway in Long Beach. George Mitsanas, Peter Hillakas and Austin Ridge of Gantry’s Los Angeles production office represented the borrower, a private investor, in the financing. The property’s tenants include Ralphs Supermarket, Nordstrom Rack, Barnes & Noble, AMC Theatres, LA Fitness and Howards Appliances.

Lawrenceville, Ga. — RealSource Group has arranged the $9.4 million sale of a single-tenant property occupied by LA Fitness at Lawrenceville Town Center, located about 31 miles from downtown Atlanta in Lawrenceville. Austin Blodgett of RealSource, in association with ParaSell Inc., represented the seller, DLC Management. The undisclosed buyer was a private investor based in Dallas. Built in 2020, the LA Fitness building spans 34,000 square feet. Tenants at Lawrenceville Town Center include Kroger, H&R Block, O’Reilly Auto Parts, Verizon Wireless, Aaron’s, Rainbow Shops, Ameris Bank, Coast Dental, Burger King, …

Egg Harbor City, N.J. — The Kislak Co. Inc. has negotiated the $7 million sale of a 5,585-square-foot retail property in Egg Harbor City, located about 20 miles from Atlantic City. The property is under construction and is preleased to convenience store operator Wawa for 20 years on a triple-net basis. Jason Pucci and Justin Lupo of Kislak represented the buyer, Kamson Corp., in the transaction. The seller was not disclosed.

Milton, Ga. — Five retailers have plans to join the tenant lineup at Crabapple Market, a mixed-use development currently underway in Milton, located about 31 miles north of downtown Atlanta. Courtney Brumbelow and Haley Hartman of Ackerman Retail completed the leases on behalf of Crabapple Market. Opening this year, the new retailers include DUA Vietnamese, a Vietnamese restaurant; Roll On In Sushi Burritos & Bowls, a restaurant that offers a mix of sushi burritos, tacos, bowls and donuts; Spiced Right Ribhouse, a barbecue restaurant; Buzzed Bull Creamery, an ice cream …

Big Bear Lake, Calif. — Progressive Real Estate Partners has arranged the sale of Village Mall at Big Bear, a multi-tenant retail property located at 40729 Village Drive in Big Bear Lake, about 41 miles from San Bernardino. An Inland Empire-based investor sold the property to a San Gabriel Valley-based investor for $3.9 million. Greg Bedell and Roxy Klein of Progressive Real Estate represented the seller, while Doreen Chen of Pinnacle Real Estate Group represented the buyer in the deal. At the time of sale, the 24,806-square-foot retail center was …

St. Cloud, Minn. — Hanley Investment Group Real Estate Advisors has arranged the $3.5 million sale of a 3,493-square-foot retail property occupied by Raising Cane’s at 2635 W. Division St. in St. Cloud. Jeff Lefko and Bill Asher of Hanley Investment Group, in association with Rob Wise of CBRE, represented the seller, TOLD Development Co. Chris Rodriguez of Pacific Commercial Investments Inc. represented the buyer, Caravella Properties. The newly constructed single-tenant property is ground leased to Raising Cane’s on a long-term, absolute triple-net, corporate-guaranteed lease.

Asheboro, N.C. — Flagship Realty LLC has purchased 1334 East Dixie Drive, a two-tenant retail building in Asheboro. The 6,400-square-foot property was fully occupied at the time of sale by Mattress Warehouse and AT&T. Jimmy Flowers of Flowers Capital Holdings brokered the $2 million sale. Flowers Capital Holdings will also manage the property. Pinnacle Bank provided a $1.6 million loan for the acquisition.