Queen Creek, Ariz. — Creation, in partnership with Horizon Real Estate Ltd., has broken ground on The Switchyard, a $120 million mixed-use project in Queen Creek, about 40 miles southeast of Phoenix. The 10-acre project will feature 54,000 square feet of restaurant, retail and office space, as well as a 215-unit apartment community. The development’s restaurant lineup will feature Postino, a restaurant and wine café; Snooze, an A.M. Eatery, a breakfast and brunch restaurant founded in Denver; and Shake Shack, a modern burger chain. Creation states that lease negotiations are …

News

San Diego, Calif. — JLL Capital Markets has arranged a $27.6 million loan to refinance Torrey Hills Center, an 86,467-square-foot retail center located in the Carmel Valley neighborhood of San Diego. Vons Market anchors the center. Originally built in 2005, the property is 98.4 percent leased to a mix of 26 tenants including Orangetheory Fitness, Starbucks Coffee, Wells Fargo and JETSET Pilates. Greg Brown, John Marshall, Spencer Seibring and Allie Black of JLL’s Debt Advisory team represented the borrower, a national real estate investment and management firm, in arranging the …

NAI Charleston Arranges Sale of 57,659-Square-Foot Shopping Center in Myrtle Beach, South Carolina

Myrtle Beach, S.C. — NAI Charleston has arranged the sale of a 57,659-square-foot shopping center located at 201-233 International Drive in Myrtle Beach. Built in 2014, the center sits on 6.4 acres, according to LoopNet. Lowes Foods anchors the center, which is leased to a mix of local and national tenants. Thomas Boulware and Michael Branch of NAI Charleston represented the buyer in the transaction. Drew Parks of Coldwell Banker Commercial represented the seller.

Houston — CenterSquare Investment Management has acquired Shops at Aliana Trace, a newly constructed, 40,000-square-foot shopping center located in Houston. The property is situated adjacent to Grand at Aliana, a 200,000-square-foot retail power center. Target and H-E-B anchor the Shops at Aliana Trace, which was fully leased at the time of sale. Additional tenants include Big Blue Swim, Salon by JC and Wayback Burgers. The property is CenterSquare’s sixth acquisition in Houston.

Punta Gorda, Fla. — Kitson & Partners has signed 20 new leases at The Shops at Yellow Pine, a 120,000-square-foot mixed-use development located in the master-planned community of Babcock Ranch in Punta Gorda. The Shops at Yellow Pine comprises three multi-tenant buildings and two standalone outparcels. Additionally, outdoor seating areas are available for use throughout the development, which is fully leased. Five Guys, Marshalls, Ace Hardware, Five Below and Hope Chiropractic have already opened at the center, while Panera Bread, Jersey Mike’s and Verizon Wireless are expected to open in June. …

JEMB Realty Secures 55,000-Square-Foot Retail Lease for Old Navy Flagship Store in Manhattan

New York City — JEMB Realty (JEMB) has secured a 55,000-square-foot lease for Old Navy at 50 West 34th St. at the center of Herald Square in Manhattan. The space — which was formerly occupied by Samsung and the Harry Potter Experience — spans two floors and will serve as a flagship store for the brand. The retail lease is the largest in New York City so far this year, according to JEMB. Ariel Schuster of Newmark, along with Gap Inc.’s real estate team, represented Old Navy, while LMJ Realty, a …

Joint Venture Acquires Two Shopping Centers Totaling 428,928 Square Feet in Rhode Island and Illinois

Warwick, R.I. and Arlington Heights, Ill. — A joint venture between Dallas-based Encore Enterprises Inc. and AmCap Management Holdings LLC, a subsidiary of Stamford, Connecticut-based AmCap Management LLC, has acquired two grocery-anchored shopping centers in Rhode Island and Illinois totaling 428,928 square feet. The properties are Cowesett Corners in the Providence suburb of Warwick and Northpoint Center in the Chicago suburb of Arlington Heights. Cowesett Corners is anchored by Stop & Shop and totals 152,595 square feet. Additional tenants at the center include PetCo, Five Below and Oak Street Health. The …

Austin, Texas — Houston-based Whitestone REIT has acquired San Clemente at Davenport, a 31,832-square-foot retail center located in Austin. Austin-based Mexican restaurant chain Fresas Chicken anchors the center. Other tenants at the property include Iron Fitness and Greenlake Energy. San Clemente at Davenport marks the fifth neighborhood shopping center Whitestone has acquired in Austin. Shea Petrick and Chris Gerard of JLL Capital Markets’ Investment Sales and Advisory team represented the seller, HPI Real Estate Services & Investments, in the transaction.

Hanley Investment Arranges $2.9 Million Sale of Single-Tenant Retail Property in Riverside, California

Riverside, Calif. — Hanley Investment Group Real Estate Advisors has arranged the $2.9 million sale of a newly constructed, 928-square-foot single-tenant retail property located in Riverside. Starbucks Coffee occupies the building on a 10-year, triple-net-lease with scheduled rent increases every five years. Situated on 0.96 acres, the building features a drive-thru and walk-up window. Eric Wohl and CJ Kiehler of Hanley Investment Group represented the seller, Atman Kadakia of Greens Group, in the transaction. Sam Olmstead of Voit Real Estate Services represented the 1031 exchange buyer, a Southern California-based private …

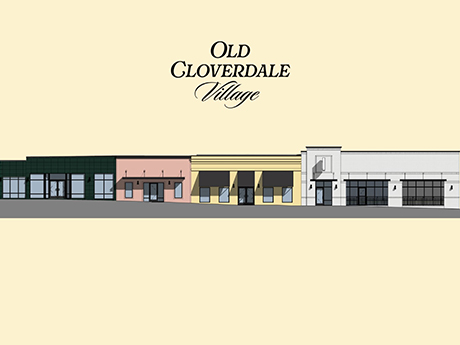

Montgomery, Ala. — A partnership between Birmingham, Alabama-based The FiveStone Group, Bayer Ventures and New York City-based D&A Cos. is underway with the redevelopment of Old Cloverdale Village, an 11,000-square-foot retail property located in Montgomery’s Old Cloverdale District. The project team comprises CCR Architecture & Interiors, Pilgreen and Bostick Engineering Inc. and Prier Construction. The partnership also includes Fresh Hospitality and Charles Morgan. The historic Old Cloverdale Village is home to various locally owned restaurants, pubs, specialty shops and art galleries, as well as an independent arts cinema and a volunteer …