Atlanta’s retail market is defined by high rents, strong demand and obstacles to both sales and development that have stymied activity.

In terms of fundamentals, it’s hard to point to a time when Atlanta’s retail market was healthier than it stands today. For starters, the market’s retail space commands the highest asking rental rates on record. Since the end of 2019, Atlanta’s asking rental rates have increased by a mean of 37 percent, according to second-quarter research from Marcus & Millichap.

“We are seeing asking rental rates reach all-time highs because there’s not much under construction,” explains Steve Triolet, senior vice president of research and market forecasting at Partners, a Houston-based commercial real estate services firm that recently opened an Atlanta office. “This is good for landlords but challenging for some retail tenants.”

Leo Wiener, president of retail at Ackerman & Co., concurs that Atlanta is currently a landlord’s market as vacancy rates are hovering in the mid-3 percent range. He points to the market’s tempered development activity and strong macroeconomic forces in recent years as helping elevate property fundamentals.

“Over the past 10 years, population growth in Atlanta was between 10 and 15 percent and retail inventory growth was around 5 percent, maybe less — that’s the story,” says Wiener.

“The market as it stands today is probably the strongest we’ve seen it in at least a decade,” adds Jesse Shannon, president and chief investment officer at Branch Properties, a locally based investment and development firm that has delivered several Publix-anchored shopping centers around the Southeast in recent years.

As space becomes available in Atlanta, sources say that landlord representatives are hearing inquiries from six to eight users that are looking for the same space at the same time. Henry Poer, senior vice president and managing principal of SRS Real Estate Partners, also notes the increased competition for available retail space in the market is putting a strain on tenants.

“As a tenant rep broker, it’s somewhat difficult to find the right space with the right economics because there’s so much competition,” says Poer.

At the property level, landlords are also seeing improved sales and foot traffic at their centers, especially those with a strong food-and-beverage tenancy and/or entertainment venues. Popular examples of such developments in the city include Ponce City Market in the Old Fourth Ward and The Works in the Upper Westside, among others.

Michael Phillips, president of Atlanta-based Jamestown, which owns and operates Ponce City Market, says that improved property performance is especially notable at Buckhead Village District in the city’s Buckhead district. The company purchased the development from developer OliverMcMillan in summer 2019 and has since rebranded the property. Phillips says that Jamestown is in the midst of remerchandising Buckhead Village District with independent retailers and modern luxury brands.

“Last year at Buckhead Village District, over 60 percent of our tenants experienced year-over-year sales growth and the property itself has seen a 22 percent jump in foot traffic,” says Phillips. “Consumers in Atlanta are increasingly seeking experiential offerings. Online shopping, while convenient, can sometimes feel like a chore. When people choose to shop in person, they are looking for an experience and an element of discovery.”

Jamestown also made perhaps the biggest news splash thus far this year with the acquisition of the Atlanta subsidiary of Cincinnati-based North American Properties.

Limited development

There is 640,000 square feet of retail space under construction in the metro Atlanta area as of September, according to research from Partners. Of that, 70 percent is preleased. Triolet notes that Partners tracks retail properties 5,000 square feet and up in its reports.

He also says that compared to some of Atlanta’s peer markets in Texas that Partners tracks, the ratio of retail space under construction relative to existing inventory is low, though there is a simple reason for that.

“Atlanta was in top five of retail square footage per capita,” says Triolet. “That plays into why we’re not seeing new construction right now.”

Sources believe that the thinning of development is helping to rightsize Atlanta’s retail market to more of an equilibrium between supply and demand. Shannon says that the metro area’s current tightness with limited new deliveries stands in a stark contrast to the city’s retail market coming out of the Great Recession.

“We suffered from oversupply coming out of 2008-2009, so the supply has been flatlining,” he says.

An obvious hindrance to new development in recent years has been the “higher for longer” environment for interest rates as it relates to construction debt financing. Before the COVID-19 pandemic and even those first two years of the outbreak, developers could secure short-term construction debt with all-in interest rates below 4 percent in some cases. Today, all-in rate are more likely to fall in the 8 to 9 percent range.

“It’s really hard to underwrite new development, but the demand is there,” says Scott Tiernan, senior vice president and managing principal of SRS.

Greg Eisenman, regional managing director of Franklin Street’s Atlanta office, adds that other cost inputs have been increasing in recent years as well for developers.

“The cost of land as well as rent rates remain high — as are construction and labor prices — making new development extremely challenging to make financial sense,” says Eisenman. He adds that the Federal Open Markets Committee’s decision to cut the federal funds rate by 50 percent offers a “glimmer of hope” to support new retail development.

Tiernan says that the Federal Reserve’s decision to cut rates will take time to work its way through the economy before it makes a meaningful impact on development.

“The development cycle is not going to pick up with the recent interest rate cut alone because there are a lot of headwinds with construction costs,” he says. “The capital markets are frozen from an equilibrium standpoint — there’s a pretty major gap between those things starting to change and actually delivering space. We are probably years away from the equilibrium and being healthier on the vacancy side.”

In the works

All eyes in the city are on Centennial Yards, a $5 billion redevelopment of the 50-acre Gulch district in downtown Atlanta. Centennial Yards Co., a partnership between an affiliate of Los Angeles-based CIM Group and a group led by Atlanta Hawks majority owner Tony Ressler, is the master developer of the project. Upon full build-out, Centennial Yards is expected to total 8 million square feet of retail, entertainment, office, hospitality and residential space.

Over the summer, Cosm, an immersive technology, media and entertainment company, inked a deal to open a three-level venue at Centennial Yards that will span 70,000 square feet. The venue will be named Shared Reality and feature live sports viewing and programming including Cirque du Soleil and immersive art experiences.

“The buzz is out there on this project,” says Triolet. “Centennial Yards has gotten a lot of attention as far as potential new retail concepts coming to the market.”

“Downtown Atlanta is such an important submarket,” adds Eisenman. “Infusing new life with these vibrant projects, exciting experiences and great food will do wonders for Atlanta and solidify it as one of the most desirable places to live nationwide.”

South of downtown is the long-awaited redevelopment of Underground Atlanta. Owner Lalani Ventures has been filling out the tenant roster with concepts including relocations of The Masquerade concert venue and MJQ Concourse nightclub. Other tenants opening include Pigalle by Paris on Ponce, Future Showbar and Restaurant, Dolo’s Pizza Co., The Frisky Whisker ATL, Insomnia Night Club, Utopia Restaurant Bar & Lounge and Atlanta Comedy Theatre. Additionally, Lalani Ventures recently formed a joint venture with Exact Capital to develop a $160 million affordable housing tower at Underground Atlanta.

In Atlanta’s West End, Ackerman & Co. and MDH Partners are putting the finishing touches on Lee + White, an adaptive reuse development that spans more than 440,000 square feet and features creative offices, a food hall, stores and eateries along the Atlanta BeltLine. Existing retailers and restaurants include Best End Brewing, Boxcar, Hop City, Monday Night Garage, The Overlook Boulder + Fitness, Plywood People, Westside Dental and Wild Heaven Beer.

“We recently finished the 929 office building at Lee + White, and we just opened up Triumph Motorcycles’ U.S. headquarters,” says Wiener of Ackerman Retail, who spearheads the leasing assignment at Lee + White. “Grady Hospital is now seeing patients; Gusto! will open this month; Strangers of Paradise, the food hall’s central bar, is open; and Atlanta Golf & Social will hopefully open by the end of the year.”

Wiener says that one of the final availabilities is for an eatery within the food hall that will house a signature restaurant. The space will include an outdoor patio that faces the BeltLine portion of the food hall.

“We’re about to announce another experiential user that was another important piece of the puzzle,” adds Wiener. “They work symbiotically with the food-and-beverage offerings that we have throughout the property.”

In the northern suburb of Johns Creek, Toro Development Co., a development firm founded by former North American Properties executive Mark Toro, is underway on its Medley mixed-use development. Plans for Medley call for 200,000 square feet of retail, restaurant and entertainment space; 900 luxury residences, featuring a mix of townhomes and apartments; 110,000 square feet of office space; and a central green space.

Committed tenants at Medley include Ford Fry’s Little Rey, CRÚ Food & Wine Bar, Fadó Irish Pub, Summit Coffee, Lily Sushi Bar, Knuckies Hoagies, Cookie Fix, Sugarcoat Beauty, BODY20 and AYA Medical Spa.

“Medley is shaping up to be an extraordinary community,” says Len Erickson, senior director of Franklin Street, who handles retail leasing at Medley. “Exciting announcements are on the horizon for Medley.”

In September, Ackerman & Co. received approval from the Design Review Board of Sugar Hill City Council to build a new retail center in Gwinnett County. The development firm aligned itself with the landowner Novare Group, which is developing the 306-unit Sugar Hill Residences next to the development site.

“It was a special situation — we talked about just being a service provider to finally aligning with the landowner/developer to enter into a venture together,” says Wiener. “It will be roughly 13,000 square feet across two buildings. The center will be highly activated with a greenway that goes throughout the property. The tenant mix will be heavily focused on restaurants.”

Branch Properties is also busy on the outskirts of the Atlanta metro area with a pair of Publix-anchored shopping centers. These include Braselton Village in Braselton and Limestone Marketplace in Gainesville.

“The Publix at Limestone Marketplace just opened,” says Shannon. “We just signed our last lease to take us to 100 percent leased. We also just broke ground on Braselton Village at 80 percent preleased, and that includes all our out lots. There is so much excess demand right now from the shops perspective that we’re fully preleasing these projects in some cases six months before we deliver.”

Due to obstacles to ground-up construction, some developers are opting to add retail density via redevelopments. One of the more notable examples locally is the transformation of North DeKalb Mall in Decatur. South Carolina-based retail giant Edens purchased the struggling 622,297-square-foot mall in 2021 and is transforming the 73-acre site into a 2.5 million-square-foot mixed-use development known as Lulah Hills.

“Lulah Hills is nestled within an underserved submarket with immense potential,” says Erickson. “Edens, known for its exceptional development expertise and understanding of the ‘third-place’ concept, is well-positioned to create something unique in this node.”

Plans include the adaptive reuse of 320,000 square feet of retail and restaurant space and the addition of 1,700 apartments, 100 townhomes and a 150-room hotel.

Also on the mall front, Gwinnett County’s Urban Redevelopment Agency just acquired a Macy’s department store and furniture store at Gwinnett Place Mall, a beleaguered regional shopping mall in the northeast Atlanta suburb of Duluth. In 2021, the county initially purchased a 39-acre portion of the Gwinnett Place Mall site, and with this 23-acre acquisition, will own a total of 76 acres.

Gwinnett County is working with CBRE for next steps in the redevelopment of the enclosed regional mall, which originally opened in 1984 and has since been used as a filming location for movies and TV shows including Season 3 of Netflix’s “Stranger Things.”

Other than mixed-use developments and multi-tenant shopping centers, one of the more unique retail experiences lies in McDonough. There, Chick-fil-A opened its first elevated drive-thru-only restaurant in late August. The property features four drive-thru lanes that run underneath an elevated kitchen that is twice the size of a standard Chick-fil-A kitchen. Food reaches the delivery team members via a custom meal transport system that uses conveyer belt technology.

“The new Chick-fil-A can reportedly can handle upwards of 1,000 vehicles per hour,” notes Eisenman.

Limited acquisitions

Along with limited new deliveries relative to its track record, Atlanta’s retail market has also experienced a lull in investment sales volume. Research from Colliers shows that quarterly sales volume in the second quarter did increase on a year-over-year basis for only the second time in the past two years.

Phillips of Jamestown opines that the dearth in sales is due in part to sellers not listing and marketing their properties for sale.

“However, when these properties come to market, they are often selling for a premium, which is indicative of a broad belief in the viability of strategically located, well-positioned retail properties,” says Phillips.

Jamestown was one of a few prominent investment and development firms to transact this year. The company purchased Fountain Oaks, a Kroger-anchored shopping center in Sandy Springs spanning approximately 160,000 square feet. Edens sold the center to Jamestown.

Edens also sold Moore’s Mill Crossing, a Publix-anchored center in the city’s Upper Westside, to InvenTrust Properties Corp. that same month.

“Grocery-anchored centers in Atlanta have been selling to institutional buyers with lower cost of capital than private investors,” says Don McMinn, executive director of Marcus & Millichap’s Taylor McMinn Retail Group in Atlanta. “Nuveen Real Estate, Jamestown, InvenTrust and Phillips Edison & Co. have all recently bought grocery-anchored centers.”

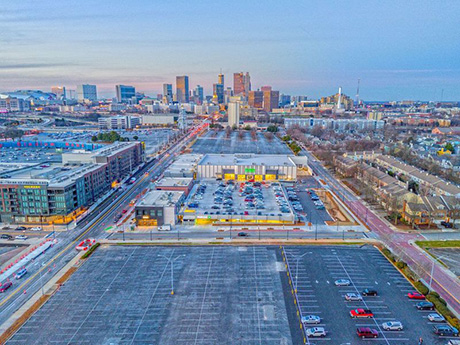

South of downtown in the city’s Summerhill district, Branch Properties recently sold Summerhill Station, a Publix-anchored shopping center along Hank Aaron Drive. The property features a Piedmont Healthcare urgent care location and is situated near Center Parc Stadium, home football arena of Georgia State University and former home of the Atlanta Braves, as well as the school’s basketball arena, Georgia State University Convocation Center.

Branch Properties purchased the development site in 2021 from Carter, master developer of the overall Summerhill revitalization that includes openings of neighborhood staples including Halfway Crooks, Wood’s Chapel BBQ, Junior’s Pizza and The Little Tart Bakeshop. Branch delivered Summerhill Station and sold it in January fully leased to San Francisco-based Stockbridge Capital Group for nearly $50 million.

“It’s a seller’s market for grocery-

anchored retail,” says Shannon. “The exit cap rates for these deals are as strong as we have seen a long

time. The only thing tempering it a little bit is the high interest rate environment.”

Curbline Properties, a spin-off of Ohio-based Site Centers Corp., recently acquired Brookhaven Station, a 44,000-square-foot, unanchored retail development that houses varies food-and-beverage eateries including Fox Bros. Bar-B-Q, Chopt, Chick-fil-A and Mellow Mushroom, as well as a Northside Hospital clinic. The

Atlanta Business Chronicle reports that the $30.2 million price tag represents the high watermark this year in terms of price per square foot.

“Curbline’s strategy is centered around buying convenience retail with the belief in the long-term value, sustainability and growth potential of this asset class, particularly in suburban areas,” says Eisenman.

McMinn says that as interest rates and exit cap rates come down, the buyer pool for unanchored retail centers like Brookhaven Station will comprise private buyers that are currently trying to time the market on single-tenant retail deals.

Taylor-McMinn Retail Group brokered a pair of sizable shopping

centers in the metro area in recent weeks. These deals include Northlake Festival on LaVista, a 367,000-square-foot retail property in Tucker, and Vickery Village, an open-air retail center in Cumming that comprises more than 200,000 square feet of retail, restaurant and office space.

McMinn collaborated on a unique opportunity in LaGrange earlier this year with partner Zach Taylor, whose specialty lies in multi-tenant shopping centers. Taylor sourced the 1031 buyer and represented the developer for the $16 million sale of a Publix-anchored shopping center.

A few months later, McMinn brokered the sale of a newly built retail outparcel at the shopping center occupied by Starbucks Coffee. The summer before, McMinn had brokered the $3.3 million sale of an outparcel restaurant at the center that is ground-leased to Chick-fil-A.

“The sum of the parts exit yielded the developer maximum proceeds,” says Taylor.

— John Nelson

This article was originally published in the October 2024 issue of Shopping Center Business magazine.