Pensacola, Fla. — Cullinan Properties has acquired Tradewinds Shopping Center, a retail center located in Pensacola, for $25 million. Totaling 178,000 square feet, the property was 95 percent leased at the time of sale. A TJ Maxx/HomeGoods combination store anchors the center, along with Jo-Ann Fabrics and Shoe Station.

News

Puyallup, Wash. — Hyperion Realty Capital LLC has acquired Meridian Place Shopping Center in Puyallup, roughly 35 miles south of Seattle. Built in 1979, the property comprises 127,429 square feet. Grocery Outlet and Michaels anchor the center, which was 70 percent occupied at the time of sale. Sean Tufts and Kevin Adatto of CPX arranged the transaction on behalf of Hyperion. An entity doing business as Meridian Place LLC was the seller.

Redlands and Walnut, Calif. — Majestic Realty Co. has arranged leases with two tenants at shopping centers in southern California. Hot Topic will open a 6,000-square-foot store at Mountain Grove Shopping Center, located in Redlands, roughly 65 miles east of Los Angeles. Additionally, CTBC Bank will lease 3,250 square feet at The Village Shopping Center in Walnut, approximately 25 miles east of Los Angeles. Majestic Realty represented the landlords in both negotiations. Beta Agency represented Hot Topic, and Miren Co. represented CTBC Bank.

Glendale, Ariz. — Thompson Thrift has broken ground on the 12-acre commercial portion of a mixed-use development underway in the northwest Phoenix suburb of Glendale. Sitting on a larger 24-acre parcel, the property will include tenants such as Black Rock Coffee, Cobblestone Auto Spa, Whataburger, Slim Chickens, QuikTrip, Extra Space Storage and a 122-room hotel. Tenants are expected to begin opening later this year. The site is located less than three miles from the city’s Sports and Entertainment District, which features State Farm Stadium, the home of the Arizona Cardinals …

Lake Mary, Fla. — Legacy Realty Group Advisors has negotiated the $46 million sale of Griffin Farm at Midtown, a 125,000-square-foot, grocery-anchored shopping center in Lake Mary, a suburb of Orlando. Jacob Baruch, Daniel Baruch and Jonah Warshaw of Legacy Realty represented both the buyer and seller in the transaction. Both parties requested anonymity, but the Orlando Business Journal reports the seller was Unicorp. Griffin Farm at Midtown is anchored by Winn-Dixie and also houses a 24-Hour Fitness location. The shopping center is part of a new mixed-use development that …

The Woodlands, Texas —Kobalt Investment Co. has acquired Creekside Park Village Green, a 74,670-square-foot shopping center in The Woodlands, about 30 miles north of Houston. Built in 2014, the center was 88 percent leased at the time of sale to tenants such as Fielding’s Local, Crust Pizza, Levure Bakery & Patisserie, Club Pilates and Cyclebar.

Everett, Wash. — Hanley Investment Group Real Estate Advisors has arranged the $2.8 million sale of a 3,816-square-foot two-tenant retail property located in Everett, roughly 30 miles north of Seattle. Jeff Lefko and Bill Asher of Hanley, in association with ParaSell, represented the private California-based buyer in the transaction. Built in 1975 and renovated in 2017, the property is occupied by Pacific Dental Services and Coldwell Banker. Micahel Finch of CenturyPacific represented the buyer, a local private investor.

Manvel, Texas — Gulf Coast Commercial Group Inc. has inked leases with two tenants, the first to sign on to the firm’s upcoming retail development in Manvel, roughly 24 miles south of Houston. Comprising 20,700 square feet, construction on the project is scheduled to begin this spring. Next Level Urgent Care will open a 3,000-square-foot location at the property, and dental practice Smile Professionals will lease a 2,500-square-foot space. Danny Miller of Gulf Coast represented the landlord in the lease negotiations. Alexander Frias of Phelps Commercial Realty represented Smile Professionals.

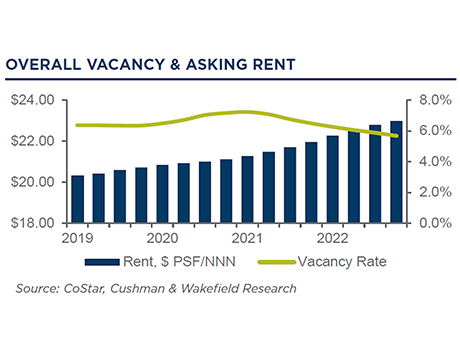

Chicago — Shopping center vacancy reached a record low during the fourth quarter of 2022, according to a report by Cushman & Wakefield. Vacancy rates declined 20 basis points quarter over quarter to 5.7 percent. Of the 81 markets tracked by the firm, 66 experienced positive net absorption. Chicago saw the highest net absorption with 1 million square feet, followed by 788,000 square feet in Phoenix; 574,000 square feet in Atlanta; 422,000 square feet in Denver; 397,000 square feet in Washington, D.C.; 392,000 square feet in Dallas/Fort Worth; and 353,000 …

Weslaco, Texas — Texas Roadhouse will open a 7,926-square-foot restaurant as the anchor tenant at the Shops at N Bridge, a retail center currently under development in Weslaco, near the Mexican border. Garansuay Group broke ground on the development in June 2022. Other tenants will include Freddy’s Frozen Custard & Steakburgers, James Avery, Paris Bakery, Jeremiah’s Italian Ice, Juice US, Benjamin Moore Paints, Cita’s Boutique, Allure Nails & Spa and Stefano’s Brooklyn Pizza. Openings are scheduled to begin this summer.