Marietta, Ga. — SRS’ Investment Properties Group has brokered the $6 million sale of The Crossing at Windy Hill, a 32,000-square-foot retail center in Marietta. The property was occupied by tenants including FedEx Office at the time of sale. Kyle Stonis, Pierce Mayson and Boris Shilkrot of SRS represented the seller, Walco Investments LP, in the transaction. Billy Benedict of Stan Johnson Co. represented the buyer, Kenny Properties LLC.

Julia Sanders

Houston — Northern Tool + Equipment has signed a lease to open a 31,000-square-foot store at Woodforest Shopping Center in East Houston. Shawn Ackerman and Jason Du of Henry S. Miller Brokerage represented the undisclosed landlord in the lease negotiations. Clay Mote of Retail Union and Jason Baker with Baker Katz represented Northern Tool.

Miami — Sprouts Farmers Market is set to open a 24,014-square-foot location at Grove Center, a mixed-use, transit-oriented development underway in Miami’s Coconut Grove neighborhood. Scheduled for delivery in 2023, Grove Center will include a 23-story residential tower with 402 multifamily, workforce and co-living units; a 1,250-space public parking garage; and 170,000 square feet of retail space. The project is being developed by a joint venture between Terra and Grass River Property. The development team includes Touzet Studio, RSP Architects and Walter Meyer of New York’s Local Office Landscape Architecture. …

Rancho Cucamonga, Calif. — Progressive Real Estate Partners and Newmark have arranged the sale of a single-tenant retail building located at 8700 Baseline Road in Rancho Cucamonga. A private, Northern California-based investor acquired the property from WM Capital for $6.1 million. Brad Umansky of Progressive Real Estate Partners and Glenn Rudy of Newmark represented the seller in the transaction. Bank of America has occupied the 9,195-square-foot drive-thru property since 1976. The building is located within Country Village shopping center.

Atlanta and New York City — Blackstone Real Estate Income Trust Inc. (BREIT) has entered into a definitive agreement to acquire Preferred Apartment Communities Inc. (PAC) for approximately $5.8 billion. Under the terms of the agreement, BREIT will acquire all outstanding shares of PAC’s common stock for $25 per share in an all-cash transaction. PAC’s portfolio includes 44 multifamily communities totaling approximately 12,000 units concentrated largely in Atlanta, Orlando, Tampa, Jacksonville, Charlotte and Nashville, as well as 54 grocery-anchored retail assets comprising roughly 6 million square feet in Atlanta, Orlando, …

Orland Hills, Ill. — Northmarq has arranged the sale of Orland Towne Center in Orland Hills, 34 miles from Chicago. The 138,000-square-foot retail center is home to Aldi, Edge Fitness, Five Below, PetSmart and Duly Health and Care. In addition to brokering the sale, Northmarq’s Jeff Frankel also arranged a $14.6 million first mortgage loan on behalf of the buyer, Sperry Equities. A life insurance company provided the fixed-rate loan, which features a 10-year term and a 30-year amortization schedule.

Attleboro, Mass. — JLL Capital Markets has arranged the sale of a 115,650-square-foot, single-tenant retail property net-leased to BJ’s Wholesale Club in Attleboro, roughly 10 miles north of Providence. Nat Heald, Chris Angelone and Zach Nitsche of JLL Capital Markets represented the undisclosed seller in the transaction. BJ’s has operated at this location since the building was constructed in 2011.

McAllen, Texas — Faris Lee Investments has arranged the $7 million sale of a 65,000-square-foot retail property currently under development in McAllen. The property is triple-net-leased to Floor & Décor, which is scheduled to open on March 3. Jeff Conover and Scott DeYoung of Faris Lee represented the seller, a Texas-based developer, in the transaction. The buyer was a Texas-based 1031 exchange investor.

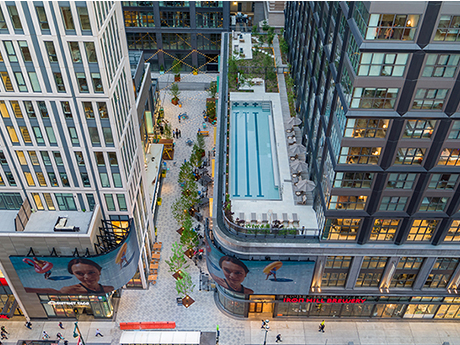

Philadelphia — JLL has arranged a $260 million loan for the refinancing of East Market, a mixed-use project that spans an entire city block in Philadelphia’s Center City neighborhood. East Market consists of two apartment buildings totaling 562 units, 120,000 square feet of retail and restaurant space and a 100-year-old warehouse that has been redeveloped into creative office space. Chad Orcutt and Blaine Fleming of JLL arranged the loan through Pacific Life Insurance Co. on behalf of the borrower, a joint venture led by National Real Estate Advisors.

Long Beach, Calif. — Gantry has arranged a $33.3 million refinancing for Marina Pacific Shopping Center, a 296,958-square-foot property located along the Pacific Coast Highway in Long Beach. George Mitsanas, Peter Hillakas and Austin Ridge of Gantry’s Los Angeles production office represented the borrower, a private investor, in the financing. The property’s tenants include Ralphs Supermarket, Nordstrom Rack, Barnes & Noble, AMC Theatres, LA Fitness and Howards Appliances.